Will the U.S. Dollar Cause a Stock Market Crash in 2016?

Although the stock market grew at a rapid clip in recent years, 2015 is shaping up as a tipping point for the economy. Growth sputtered to a near standstill by the middle of the year as the economy was plagued by a bundle of problems. Tectonic forces beneath daily market movements continued raising fears of a U.S. dollar collapse in 2016.

There are two main factors that could trigger a U.S. dollar collapse. China could achieve reserve currency status for the yuan, undermining the relevance of the U.S. dollar and U.S. stock markets could crash. Again.

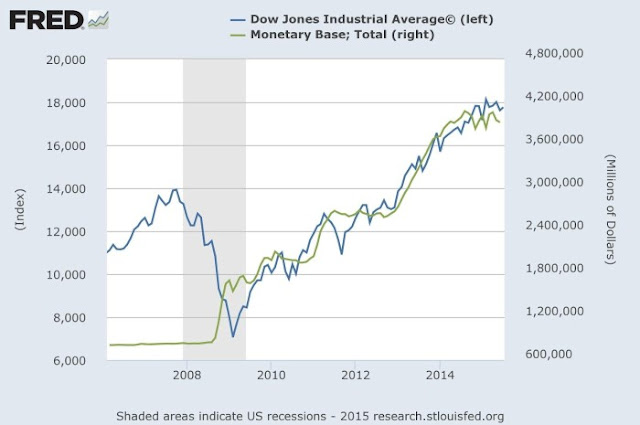

Think of how the world is changing. Since the 2008 stock market crash, asset prices were buoyed by easy money from the Federal Reserve. Stock markets soared as investors regained their confidence. But that confidence came at a steep price.

The Federal Reserve spent more than $4.0 trillion preventing both a stock market crash and the U.S. dollar collapse. Unfortunately, quantitative easing wasn’t meant to last forever.

The Fed finally wound down their bond buying program last year, injecting a strain of worry into stock markets. We’ve seen that strain grow into a full-fledged panic this year, with markets gyrating wildly through the summer.

Why are they panicking? Well, the short answer is that monetary stimulus is nearly at an end.

But what does that mean for U.S. stock markets? Does it necessarily signal a U.S. dollar collapse in 2016? The answers are far from clear, but there are legitimate fears of an economic collapse. At the very least, a stock market crash is virtually guaranteed.

Consider this; at the same time the Federal Reserve is wrapping up its monetary stimulus, we’re seeing a massive reordering of global power. China has evolved from being a regional power to a heavyweight on the international stage.

Russia successfully annexed Crimea and Eastern Ukraine without any practical opposition from the West, and Iran has been admitted back into the community of nations. The world has changed a lot in a surprisingly short while.

We’re no longer living in a unipolar world where America could singlehandedly dictate terms to everybody else. These days China, Russia, Germany, Iran, and Saudi Arabia are powerful geopolitical forces in their own right.

As political power redistributes to these countries, so too will capital flows. The U.S. dollar will be brought down from its pedestal and be measured alongside the yuan and the ruble. That much is clear.

Will the U.S. Dollar Lose its Reserve Currency Status?

One potential factor in a U.S. dollar collapse in 2016 is the rise of the yuan. China’s currency is growing ever more important in world affairs, and it’s not by accident.

Time and again, the country’s leaders have announced their intention to gain reserve status for the yuan. Reserve currencies are essentially the backbone of international finance.

Central banks across the world hold large quantities of these currencies as a way of gaining credibility for their own country’s currency. Granting China reserve currency status would symbolize its transcendence in the world order.

There are currently seven reserve currencies in the world, but none come close to the U.S. dollar. As a percentage of total holdings, the U.S. dollar accounts for more than 63% of currency reserves, followed distantly by the euro at 21%.

This wasn’t always the case. Before WWI, currency reserves were made up of British Pounds Sterling, French francs, and German marks.

At the time, Britain dominated world trade and produced the most goods, forcing a majority of international transactions to be conducted in pounds sterling. After WWII, the German mark was replaced by the U.S. dollar in the basket of reserve currencies.

The decline of the British Empire came at a great time for the U.S.

Global trade shifted toward the American economy during the aftermath of WWII, putting the U.S. dollar at the forefront of international finance. But now China has surpassed America as the largest merchandise trader in the world.

Doesn’t that mean the yuan is destined to be the next primary currency?

If you told someone back then that the U.S. dollar could collapse in 2016, they would probably fetch you a doctor. Heck, a U.S. dollar collapse would have sounded crazy even five years ago.

But the circumstances have altered more than anyone could have imagined. And it’s important to recognize that. This is the pattern history has revealed to us. When a country dominates world trade, it becomes the world’s primary currency.

By that logic, China’s ascension to reserve currency is all but guaranteed. The International Monetary Fund (IMF) has promised a decision on the country’s application for reserve currency status by the end of 2015.

If China is successful, it’s fairly possible we’ll see a U.S. dollar collapse in 2016.

Impact of China’s Stock Market Crash on U.S. Dollar

However, China is facing some hurdles of its own that could turn the IMF against them. IMF support was conditional on China embracing the ups and downs of free market capitalism, including the unrestrained movement of currencies. (Source: Financial Times, August 20, 2015.)

But China used a heavy hand in markets after the country’s stock market crash this past summer. Starting on June 12, 2015, we saw China’s stock market start to crumble.

Investors were riding high off a credit boom in the preceding year, but regulators tried to reign in the excessive use of leverage. That didn’t go down too well.

The Shanghai Stock Exchange lost over 30% of its value in a single month as hundreds of companies fought to remain solvent. Fear was epidemic. Nearly two thousand companies halted trading on their stock as prices plummeted.

China’s government stepped in to stabilize the stock market. They took extreme measures to control the sell-off, including jailing short sellers and propping up endangered companies.

Then they started printing lots and lots of money. On top of that, China lowered interest rates and devalued the currency. These measures helped stabilize asset prices but the IMF wasn’t too happy about it.

Here they were examining China’s application for reserve currency status, and the country goes and starts a currency war. That could have postponed a U.S. dollar collapse past 2016, but China managed to find a tiny loophole in the IMF’s suggestions.

China’s currency has two different values: the onshore yuan and the offshore yuan. The government sets a target for the onshore value, but the offshore floats freely. By providing two different rates for the yuan, China is trying to convince the IMF it can be liberal.

But the onshore yuan allows them to retain some control. It’s a clever little ruse that effectively gives China the power to counteract another stock market crash without relinquishing their pursuit of reserve currency status.

Will the U.S. Stock Market Crash?

We’ve covered China’s impact on the U.S. dollar quite extensively, but what about here at home? How is the U.S. economy performing?

At the first glance, most analysts would answer with a resounding “yes.” The S&P 500 and the Dow Jones Industrial Average are up 120% and 94% respectively, while the NASDAQ Index gained a whopping 184%.

It’s hard to characterize those gains as anything but impressive. Yet the security of those gains is what investors should be worried about. Rather than patting ourselves on the back, we need to double-check the integrity of our stock market profits.

Not all bull markets are real. Some are the construct of excessive optimism in the market, while others (like in China) are built on a credit bubble. Only on rare occasion do stock markets soar wildly on genuine economic results.

More often than not, investors just start drinking their own Kool-Aid. The desire to see higher stock prices becomes a self-fulfilling prophecy—a vicious cycle where investors feed on their own optimism.

It constantly amazes me how quickly investors forget that another stock market crash would spark a U.S. dollar collapse. Think about this: in the third quarter of 2015, 71% of companies issued negative earnings guidance, meaning they’re pessimistic about future growth. (Source: FactSet, July 31, 2015.)

Despite this admission, stock prices are rising faster than earnings per share.

Don’t they understand that stock prices don’t rise in perpetuity? When earnings slow down, the stock market should decelerate as well. Another probable cause of a stock market crash is the coming interest rate hike.

The Federal Reserve has deliberately kept interest rates near zero percent for the last few years. Big banks were effectively borrowing money for free—something the Fed hoped would spur lending in the economy.

However, we were just coming off a massive stock market crash and housing bubble collapse, and people were reluctant to borrow money. Everyone was tightening their belts, including businesses that had fewer customers.

The collective impact of all that reduced spending was devastating on the economy, but the U.S. dollar was supported by an influx of capital from overseas. Although the U.S. economy was in bad shape, the rest of the world was worse.

Like Alan Greenspan said in 1998, “it is just not credible that the United States can remain an oasis of prosperity unaffected by a world that is experiencing greatly increased stress.” (Source: Federal Reserve, September 4, 1998.)

We cannot reasonably expect investor confidence in the U.S. dollar to be unlimited. There are consequences for repeated stock market crashes.

Another economic collapse would decimate investor confidence in the American dream. They would abandon U.S. stocks in favour of hard assets like gold and silver, sparking a collapse of the U.S. dollar like we’ve never seen before.

I’m not arguing that an interest rate hike would single-handedly destroy the value of the U.S. dollar. My point isn’t that the U.S. dollar will disappear into the pages of history. But we cannot avoid some basic truths about the correlation between quantitative easing and the stock market recovery.

Between 2009 and 2015, growth in the Dow Jones Industrial Average almost perfectly mirrors expansion in the monetary base. Wall Street has developed a sense of sheltered safety much in the same way children feel safe with their parents.

Underlying the complex risk analysis done on Wall Street is a simple calculation that uses no number. And it goes something like this: don’t worry; the Federal Reserve will save us.

But the gravy train is coming to a stop. The Fed’s insistence on a rate hike this year makes it nearly impossible for them to backtrack. They are running out of road, so there’s nowhere to kick the can.

The Federal Reserve Open Markets Committee is meeting again in December for their quarterly review. Most analysts, myelf included, expect the Fed to raise interest rates by 0.25% at the next meeting.

Under normal circumstances, 0.25% isn’t a big deal. By itself, an interest rate hike isn’t enough to cause a U.S. dollar collapse, but that’s where context comes in.

It matters that we’re seeing a global shift in power towards China when the U.S. economy is weakest. China is the largest force in global trade and history suggests they will become the world’s leading reserve currency.

Economic Collapse Headed for U.S. in 2016

At the same time, the U.S. stock market is overinflated and addicted to easy money from the Federal Reserve. The bubble is built and it is astonishingly vulnerable to even the slightest shocks. That’s the nature of bubbles.

With a backdrop that volatile, shouldn’t everyone be worried about a U.S. dollar collapse in 2016?

Source: http://www.profitconfidential.com/u-s-dollar/will-u-s-dollar-collapse-in-2016/

myfAd is a viral online marketing system

Add a comment